by: Richard A. Anderson

On September 21, 2018, the Global Industry Classification Standard (GICS) sector structure will experience the biggest change in its history. Specifically, the Telecommunication Services sector will be broadened to include companies from the Consumer Discretionary and Information Technology sectors and renamed Communication Services. Other highlights of changes to GICS include:

• Media companies will move from Consumer Discretionary to Communication Services

• Internet services companies will move from Information Technology to Communication Services

• E-commerce companies will move from Information Technology to Consumer Discretionary

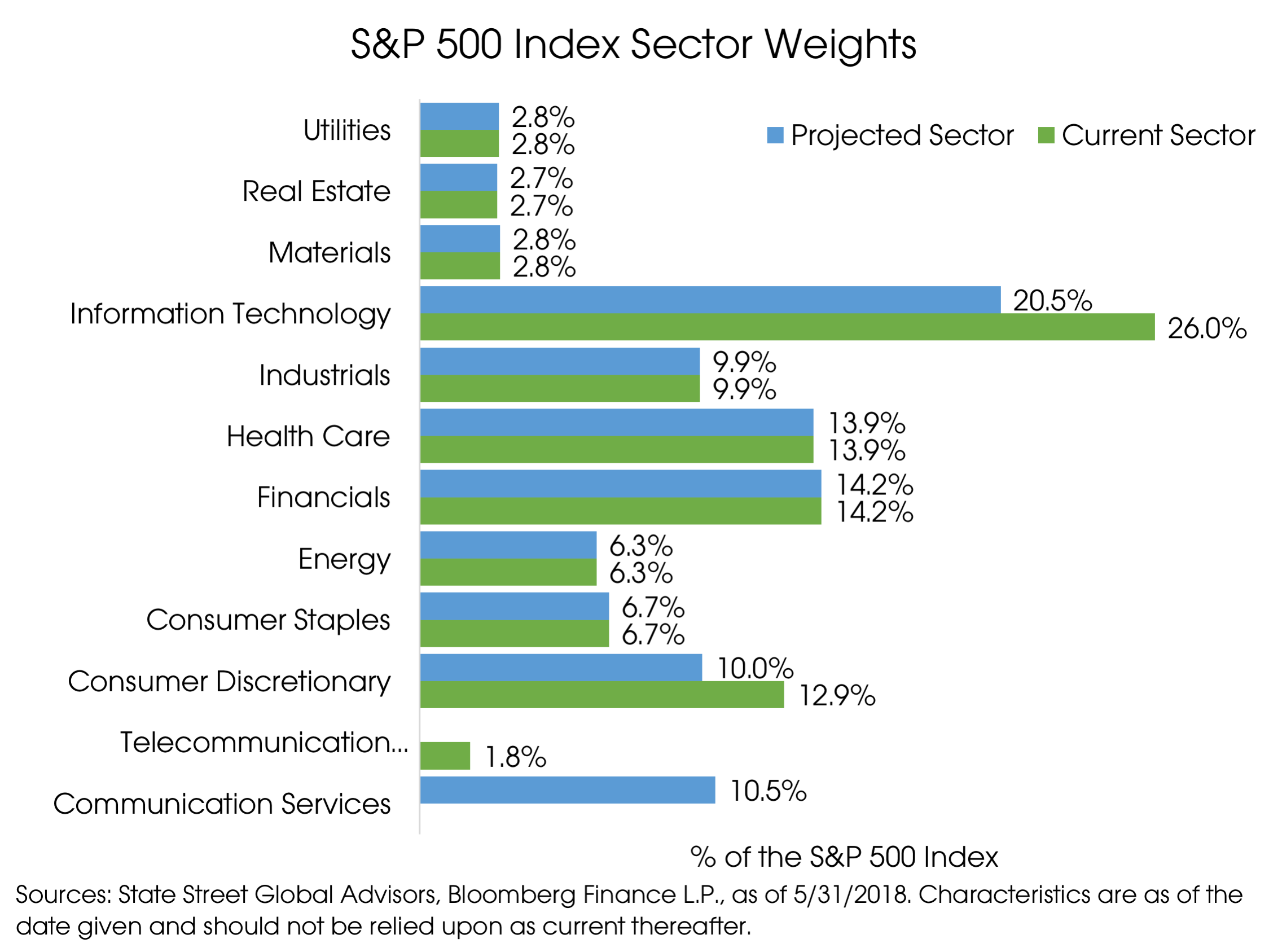

Based on research from State Street Global Advisors, the parent company of the SPDR Select ETFs, this change will result in more than 10% of the S&P 500 Index market capitalization being re-classified. However, the impacts on the individual sectors of the S&P 500 Index are even more important.

A total number of seventeen stocks that comprise nearly 24% of the S&P 500 Consumer Discretionary sector will move to the new Communication Services sector. The biggest names in this group include Netflix (NFLX), The Walt Disney Company (DIS), and Comcast Corporation (CMCSA).

A total number of seven stocks that comprise nearly 21% of the S&P 500 Information Technology sector will move to the new Communication Services sector. The biggest names in this group include Facebook (FB), Alphabet Class C (GOOG), and Alphabet Class A (GOOGL).

When the changes are complete, the Communication Services sector will represent approximately 10% of the S&P 500 Index. For comparison purposes, the current Telecommunication Services sector represents about 2% of the S&P 500 Index. The new Communication Services sector will be composed of 30% Consumer Discretionary, 52% Technology, and 18% Telecommunication stocks based on current GICS sector classifications. This also means that the Information Technology sector will shrink from 26% to about 20.5% of the S&P 500 Index.

As a result of technology companies being added, the new Communication Services sector will have a dividend yield of less than 2%, compared to a 5% dividend yield for the current Telecommunication Services sector. In the past, the Telecommunication Services sector was viewed as a defensive sector that would not have as much volatility as the market because of its number of high dividend-paying stocks. Investors viewed these high dividend-paying stocks as bond-like investments. However, the new Communication Services sector will contain more growth-oriented stocks that should add to the volatility of the sector.

The new Communication Services sector is designed to reflect current communication methods and information distribution instruments. Under the new design, the Communication Services sector will expand to include companies that enable communication and offer content and information through diverse media channels.

While this change to the GICS structure is a vast improvement, it is far from perfect. This is because many of the largest companies do not fit neatly in one sector. For example, Amazon is classified as a Consumer Discretionary stock. Amazon is an online marketplace, but an argument could be made that the company should be classified as Communication Services or Information Technology due to its vast line of products and services. The same is true for Apple. S&P Dow Jones and MSCI, the governing body of GICS, are attempting to have the sector classification reflect the economy. They’re trying their best, but sometimes you just can’t fit a square peg in a round hole.

Ultimately, this change has little impact on how we construct portfolios at HIGHLAND. We don’t believe investing in individual sectors adds value over the long-term and we certainly don’t believe it is possible to time when to buy in or sell out of individual sectors. Our investment philosophy is to be sector agnostic; what matters more is the company’s fundamentals rather than its sector classification.

For those who believe sector rotation strategies do add value, good luck in the future. This change will definitely complicate their lives as all the trends and data from the past will essentially need to be thrown out the window. The Information Technology, Consumer Discretionary, and Telecommunication Services/Communication Services will look completely different going forward, making historical data useless.

For investors who hold sector ETFs or mutual funds, their investments may no longer track the markets they were once originally designed to capture. On the other hand, the manager may be forced to buy or sell securities to align with the new classification system. This may result in added taxes and transaction costs, which will reduce your net return.

These complications associated with sector investing only serve to reinforce our belief that investing in diversified mutual funds and ETFs that capture the broad stock market is the most efficient way to build and maintain long-term wealth.