If you are a parent with a child in college or paying off debt yourself, you probably are all too familiar with the astounding costs of a college education. With the average annual cost of a four-year private college at $49,320, it’s important to be realistic about how much of the tuition will be funded by student loans.

According to Student Loan Hero™, “Americans owe over $1.45 trillion in student loan debt, spread out among 44 million borrowers.” Student loan debt is nearly $620 billion more than the total U.S. credit card debt. Based on 2016 figures, the average loan balance per student is $37,172 which equates to a monthly payment of $351.

It is important to understand the benefits of education financed through student loans while preparing the correct course of action to repay the loans. The requirement to make student loan payments and creating a budget can be an opportunity for the student to develop financial responsibility and can be used as an educational tool for the parents. Learning to manage debt and income responsibly will be a necessary foundation for repaying debt and creating wealth. This article will give an overview of federal loans as well as information on how to begin organizing your loans in a concise way that will help present possibilities to repay the obligations.

Main Federal Student Loan Types

Federal student loans are designed to provide low-interest borrowing and flexible repayment options that come with perks available only to federal loans. It’s important to understand the type of loan obligations and be aware of the different courses of action that are available. Not all student loans are structured the same and will affect eligibility for certain borrower protections and debt relief programs such as income-driven repayment plans and Public Service Loan Forgiveness.

1) Federal Direct Loan Program: This program is the largest of the federal student loan programs. The funds for the loans come directly from the US Department of Education and has a fixed interest rate for the life of the loan.

a. Subsidized Loans: Students must show financial need, and the interest on these loans are paid by the government while in school. The loan amounts per year are capped at $5,500.

b. Unsubsidized Loans: There are no requirements to show financial need to obtain the loan. The interest accrues while in school and is added to the total liability amount. During periods of deferment or forbearance, the interest will, also, accumulate even if payments are postponed. The maximum annual award is $20,500.

c. Direct PLUS Loans: Parents of dependent undergraduate students, graduate students, or professional students can take these loans. Financial need does not need to be demonstrated. Please note, parents are responsible for interest on loan from the first month. The loan is a liability of the parent, and the balance cannot be transferred to student.

2) Federal Perkins Loans: As of September 20, 2017, the program expired and is awaiting further action from Congress. These are low interest federal student loans where the student expresses financial need. The school is the lender but not all schools participate in the program. Undergraduates qualify for $5,500, and graduates qualify for $8,000 in loans per year.

3) Federal Family Education Loan (FFEL) Program: Private lenders offered federal student loans to students which in turn were reinsured by the federal government. As a result of the Health Care and Education Reconciliation Act of 2010, no new FFEL Program loans were made from July 1, 2010.

Student Loan Inventory

Once you have a general knowledge of the types of loans offered, it is important to understand the terms of the loan obligations before evaluating the best option and creating a repayment game plan. One of the best ways to keep track of the loans is using a spreadsheet. Laid out below is a sample of the type of information to include. Each component will give you an arsenal of information to tackle the debt without negatively impacting your current finances. Depending on your current situation, you may be able to take advantage of opportunities only offered with certain federal loans.

If you are not aware of the specific information, there are a couple ways to access it:

1) Log into your loan servicer’s account

2) Obtain a copy of your credit report for a list of all outstanding debt

3) Review the promissory note signed at the commencement of the loans

4) Retrieve records at www.nslds.ed.gov - NSLDAS is the U.S. Department of Education’s central database for student aid.

With this information organized, you will be able to identify the benefits that are synonymous with your student loans and make the right decisions to start a healthy financial foundation. If there are questions you have pertaining to your loans, contact the loan servicer to clarify.

Student Loan Repayment Options

To make your payments more affordable, repayment plans can be based on length of time or driven by income. Although you may select or be assigned a repayment plan when you first begin repaying your student loans, you can change repayment plans at any time.

There are eight different repayment plans offered:

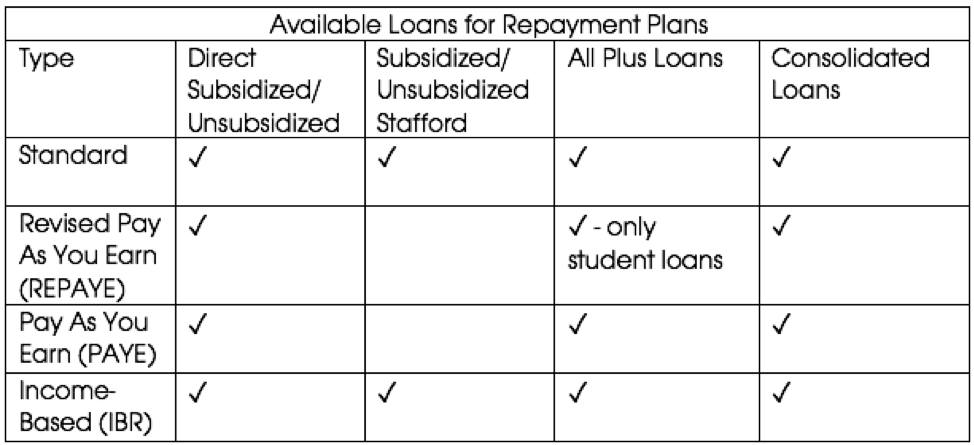

Below are four of the key repayment plans. For more information on all of the repayment plans, you can go to studentaid.ed.gov or talk to your loan servicer.

1) Standard: This is the basic repayment plan. Payments are fixed and made for up to 10 years. The monthly payments may be slightly higher than other payment options, but the loan will be paid off in the shortest amount of time.

2) Pay As You Earn (PAYE): This is an income driven repayment plan where the payments are limited to 10 percent of discretionary income and limited to new borrowers after Oct 1, 2007. At the end of a 20-year repayment term, any outstanding loan balance is forgiven as long as no payments were missed during the term. Depending on the date your student loans were disbursed, it may cap loan payments at a smaller percent of income, meaning that payments could be lower.

3) Revised Pay As You Earn (REPAYE): This income driven repayment plan limits your payments to 10 percent of your discretionary income. Any Direct Loan borrower is eligible to select this plan. This is the revised version of PAYE which opens eligibility to more borrowers. Loan balances are forgiven after 20 years of eligible payments for undergraduate degrees and 25 years for graduate and professional degrees. If the monthly payment does not cover the interest charged, the Department of Education (DOE) will pay any excess interest for up to three years and then 50% of the unpaid interest.

4) Income Based (IBR): For this repayment plan, the monthly payment will be 10-15% of discretionary income if you're a new borrower but never more than the 10-year Standard Repayment Plan amount.

Payment options 2 through 4 are recalculated every year based on updated income and family size. If you file a joint tax return with your spouse, your household income will be used to calculate the monthly payment amount.

Only under the income-driven repayment plans may the remaining balance of your loan be forgiven if it is not repaid in full after 240 months (20 years) for undergraduate debt or 300 months (25 years) for graduate debt. If you are not in any of the income repayment plans currently, the clock will start when you enroll in the new plan. The chart below indicates what type of repayment plan different loans can be placed in.

For more information, go to the Repayment Calculator to compare the different types of repayment plans based on the actual loans. This will calculate a rough estimate of what you would be paying in each of the plans and some additional information on how it is structured.

Student Loan Consolidation

A Direct Consolidation Loan allows you to consolidate multiple federal loans into one loan which results in a single monthly payment. Loan consolidation can, also, provide access to the loan forgiveness programs that were not available in your current repayment plan.

Because consolidation usually increases the period of time you to have to repay your loans, you may pay more in payments and interest. Once your loans are combined into a Direct Consolidation Loan, they cannot be removed.

It is important to remember that if any of your current loans are in any of the income repayment plans, be wary of consolidating. If you’ve already made progress toward loan forgiveness in any of the income-driven plans, consolidating will start the clock over. For example, if you’ve been in an income-based repayment plan for five years and consolidate all your loans, you will lose the five years progress you made toward forgiveness. Consolidation would be ideal for those beginning the repayment process or are not in the income driven repayment plans.

Alternatives to Traditional Federal Student Loans

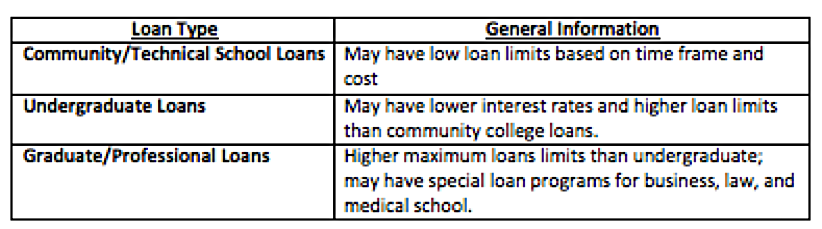

Generally, students should only consider obtaining a private education loan if they have maxed out the federal loan options. Although federal student loans are typically the most affordable, it may not be a complete solution for every student because there are limits on how much can be borrowed each year. There are alternative options that can cover the gap between college tuition and the federal aid received.

Private Student Loans

Unlike federal student loans, private student loans are funded by banks, credit unions, and other types of lenders. Private student loans offer various loan terms, interest rates, and repayment options based on the type of degree being earned. Lenders can have several elements impact the borrowing terms where interest rates will vary based on the borrower’s and co-signer’s credit. There could be a maximum annual or total limit that can be borrowed from the lender which may even aggregate the total amount borrowed between private and federal loans.

There are four key areas to compare when selecting a private loan:

product offerings

eligibility

cost

miscellaneous benefits.

Research the lender’s eligibility requirements to ensure that you are likely to qualify for the loan that fits your needs.

There may be an origination fee or other annual fees associated with the creation and maintenance of the loan. Some benefits to lessen the burden of repaying the loan are not offered on all private loans like a lower interest rate, improved service, autopay, early repayment options, etc., so review all the terms of the loan before signing.

Peer to Peer Lending

Another option is peer to peer lending which has transformed into a viable supplemental option for borrowing. It provides a formal structure for you to ask your social networks or unaffiliated third parties to make loans. This formalizes the entire process and usually settles on terms that may be more favorable than traditional private loans through a bank. Some providers include Lending Club, People Capital, Green Note, and Sofi.

Disadvantages of Alternative Student Loans

One of the downsides to private and peer to peer student loans is the interest is not tax deductible. Under the final iteration of the Tax Cuts and Job Act of 2017, student loan borrowers can still deduct up to $2,500 of the interest paid directly from their taxable income for Federal student loans only.

Another downside to private and peer to peer student loans is you lose the protection that is associated with federal loans like flexibility with different repayment options and loan forgiveness. Please be aware that once you leave the federal program, you cannot return and are no longer eligible for the popular federal income-driven repayment plans.

Concluding Thoughts

There are many factors to consider when evaluating the best course of action for loans. Knowing and understanding the dynamic of your student loans is an important step in navigating the path to financial success.

If you have any questions about the repayment options offered, please contact a member of the HIGHLAND team.