By: Reed C. Fraasa, CFP®, AIF®, RLP®

On July 3, Congress passed a major tax-and-spending bill that Republicans call the One Big Beautiful Bill Act (OBBBA), and President Trump signed the bill into law on July 4. While this legislation doesn't radically change the tax landscape like the 2017 overhaul, it does bring new planning opportunities and potential pitfalls depending on your income level.

Some describe the OBBBA as a new tax cut; however, it extends the 2017 Tax Cuts and Jobs Act (TCJA) cuts set to expire on December 31, 2025.

The TCJA created a complex political and budgetary situation. To pass through Senate budget reconciliation rules, lawmakers made individual tax provisions temporary—expiring December 31, 2025—while keeping corporate cuts permanent. Republicans argue this was a procedural necessity, not policy intent, and that extension was always expected. Democrats counter that the temporary nature was a deliberate design to obscure the actual fiscal cost.

The debate over whether extending these provisions counts as "new" tax cuts reflects fundamentally different approaches to measuring fiscal impact. Budget analysts use "current law baseline," which assumes the provisions expire as written, making any extension technically a deficit-increasing "new" tax cut. Extension supporters argue that after eight years, these rates represent economic reality rather than temporary policy.

Congress has done this dance before. The Bush tax cuts were extended multiple times before becoming permanent in 2012. The Alternative Minimum Tax "patch" was extended annually for years. Business tax incentives routinely get extended through "extenders" packages. Temporary provisions are often designed with extension expectations built in.

The 2017 Congressional Budget Office knew this, too. Their analysis projected the TCJA would increase deficits by $1.5 trillion over 10 years, assuming expiration as written. However, they also acknowledged that extending the temporary provisions would roughly double the impact of this deficit—the potential for extension and its fiscal consequences were already understood.

By 2025, supporters argue, the TCJA rates have become the established baseline after eight years of implementation. Individuals and businesses have made financial decisions based on these rates, and extension would maintain what taxpayers have relied on since 2018.

Critics contend that allowing temporary provisions to expire as written isn't a "tax increase" but a return to the previously established tax structure. They argue that calling expiration a "tax increase" accepts the premise that temporary cuts should be permanent, effectively making all tax cuts immune from expiration regardless of their fiscal impact or original legislative intent.

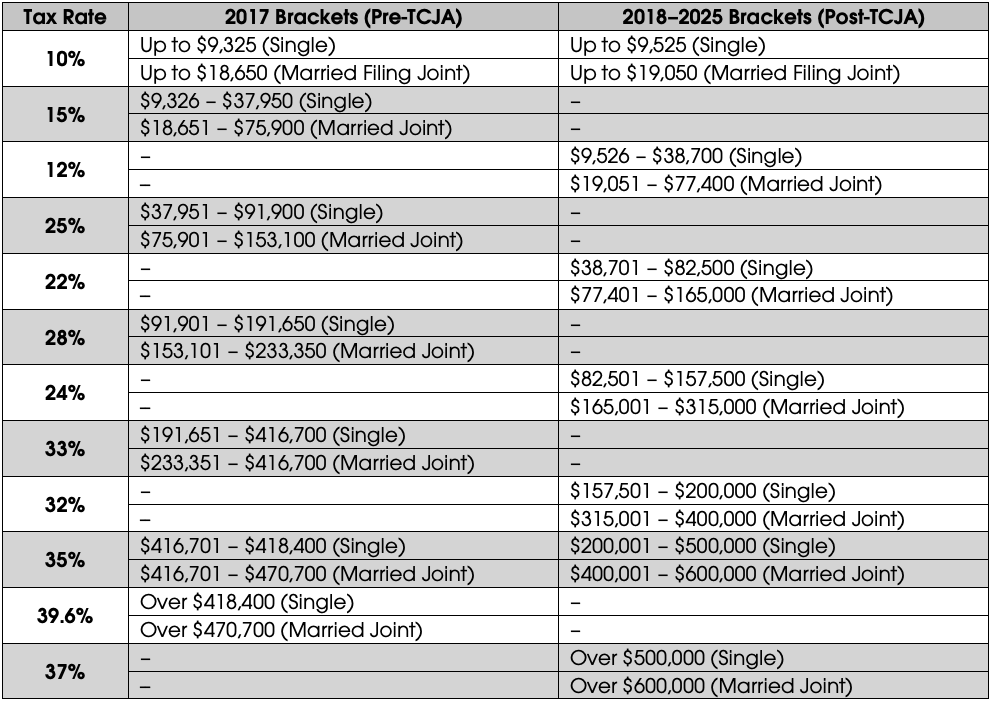

Regardless, the fact is that we now know what the tax regime will be for the near future. Most notably in the recently passed OBBBA, the tax rates and brackets won't change. The rates set in 2017 will remain at 10%, 12%, 22%, 24%, 32%, 35% and 37%. Let's first look back and see the difference between the pre-TCJA rates (what we would have if allowed to expire) and the post-TCJA rates (what OBBBA made permanent).

Key Differences:

The TCJA reduced most tax rates and compressed some brackets.

The top rate dropped from 39.6% to 37%.

Many income ranges shifted downward, making the brackets "wider" for many taxpayers.

In addition to retaining the same tax rates and brackets, several other new tax provisions must be considered. Let's break this down for households earning less than $500,000 and those earning more, and clarify which provisions are permanent and which will sunset in a few years.

For Households Earning Less Than $500,000

The new law provides a series of enhancements and targeted tax breaks that may reduce your tax bill in the short term:

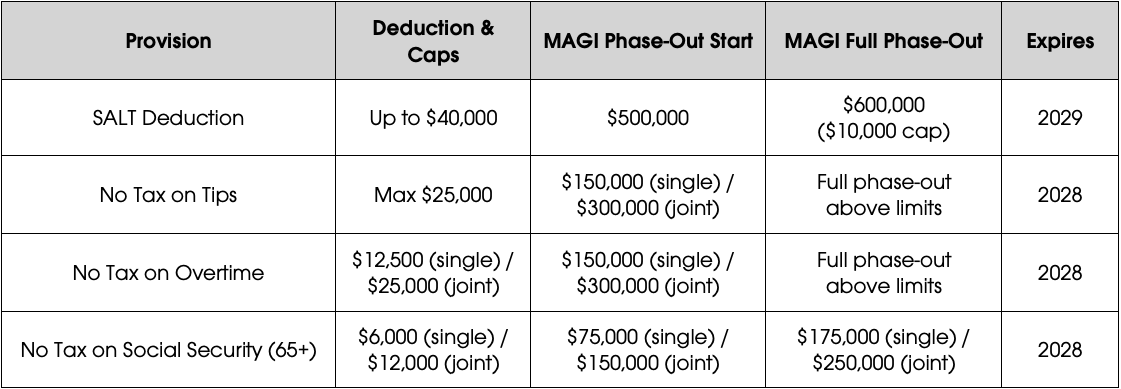

✅ State and Local Tax Deduction (SALT) Expansion

The cap on deducting state and local taxes rises from $10,000 to $40,000 for households with income up to $500,000.

Example: A married couple earning $250,000 in New Jersey, paying $30,000 in property and income taxes, can now deduct all of it, potentially saving thousands in federal taxes.

⏳ Temporary: This provision expires at the end of 2029.

✅ Increased Child Tax Credit

The child tax credit rises from $2,000 to $2,200 per child starting in 2025 and will adjust for inflation.

✅ Permanent.

✅ "No Tax on Tips" and "No Tax on Overtime" Deductions

Service workers can deduct up to $25,000 in tip income (phases out above $150,000 single / $300,000 joint). Employees earning overtime can deduct up to $12,500 (single) or $25,000 (joint) of overtime pay.

Example: A nurse earning $90,000 in base salary and $15,000 in overtime could deduct all overtime pay, lowering taxable income.

Example: A restaurant server earning $45,000 in wages and $15,000 in tips could deduct the full $15,000.

⏳ Temporary: These deductions expire at the end of 2028.

✅ Car Loan Interest Deduction

Deduct up to $10,000 of car loan interest for passenger vehicles.

⏳ Temporary: Expires after 2028.

✅ Standard Deduction Increase

The standard deduction rises to $15,750 (single) / $31,500 (married filing jointly) for 2025 and adjusts for inflation in future years.

✅ Permanent.

✅ Above-the-Line Charitable Deduction for Non-Itemizers

A $1,000 (single) / $2,000 (joint) deduction for charitable giving, even if you don't itemize.

⏳ Temporary: Expires after 2028.

✅ No Tax on Social Security

Introduces a new basic deduction for Social Security recipients of $6,000 for single filers aged 65 or older, and $12,000 for married couples (both 65+), intended to reduce federal taxable income by that amount. Phases out between $75,000–$175,000 for individuals, and $150,000–$250,000 for married joint filers.

⏳ Temporary: Expires December 31, 2028

For Households Earning More Than $500,000

If your household income exceeds $500,000, you'll find fewer benefits from the new tax law—and some new limitations to navigate:

⚠️ SALT Deduction Phase-out

The expanded $40,000 SALT cap phases out entirely for households earning more than $500,000. With a phase out between $500,000 and $600,000, high earners remain limited to the original $10,000 cap.

⏳ Temporary: This provision expires at the end of 2029.

⚠️ Charitable Deduction Limitation

Starting in 2026, itemizers lose part of their deduction equal to 0.5% of their modified adjusted gross income (MAGI).

Example: A family with $1 million MAGI would lose the first $5,000 of charitable donations as a deduction.

⏳ Temporary: Ends after 2028.

✅ Estate and Gift Tax Certainty

The estate and gift tax exemption will rise to $15 million per person in 2026, with inflation adjustments thereafter.

✅ Permanent.

✅ Qualified Business Income Deduction Stays

The 20% deduction for pass-through businesses remains in place.

✅ Permanent.

Permanent vs. Temporary and Phase-out Provisions at a Glance

It is interesting to note that many of the new tax provisions are set to expire in 2028 and 2029, around the time of the next Presidential general election cycle. The Republicans have clearly determined to make these issues for the next election.

Key Planning Strategies

Although most of the OBBBA is a continuation of existing tax law, a few changes can be considered in your financial planning.

Under $500,000 households: Take advantage of temporary deductions and tax-free income (tips, overtime, SALT cap) during 2025–2028 while available. Plan major purchases like cars or charitable gifts before these provisions also sunset.

If you are in a low to moderate income range and will benefit from no tax on tips or overtime pay, be prudent and save and invest the tax difference, which could be thousands of dollars. Many people may instead adjust their lifestyle, spending upwards to enjoy a higher net income, only to be in a tight spot if the provisions are not extended.

Roth Conversions for post-retirees will continue to be a prudent strategy to lower IRA RMDs and create tax-free income that can be left to your children. Many high-income retirees are in the 22% to 24% bracket, even with a Roth Conversion.

Over $500,000 households: Focus on income reduction strategies to avoid the charitable deduction haircut starting in 2026.

The final bill retained the full PTET/BAIT workarounds for ultra-high income through a pass-through entity, thus avoiding even the $40,000 SALT cap and phase-outs.

With the increase in the estate lifetime gift exemption of $15 million ($30 million for a couple), ultra-high-wealth families should consider additional transfers to existing Spousal Lifetime Transfer Trusts (SLATs) or establishing SLATs for long-term estate planning.

What Does All This Mean for Deficits and the National Debt?

The Congressional Budget Office (CBO) projected that letting the TCJA expire in 2025 would reduce the deficit spending by around 0.7 % of GDP, or approximately $200 billion less in federal deficit spending in 2026. Projected over the next ten years is how you get to the $4 to $5 trillion in additional debt without any spending changes. However, the math is not that simple. Events like recessions, wars, pandemics, and hyper-economic growth can all impact these projections negatively or positively.

In addition to tax revenue, tariffs and spending policy can impact the deficits. The OBBBA also has many spending cut provisions that may impact deficit spending; however, many of them are broadly sketched, meaning Congress will need to define and implement most of the details over months (or even years).

Before the spending cuts, the Congressional Budget Office estimates OBBBA adds ~$4.45 trillion in tax cuts over the next ten years, and the spending cuts offset the tax cuts by ~$1.1 trillion over the same period. This is how you get to the ~$3.3–$3.4 trillion additional federal debt over the next 10 years. The spending cuts (~$1.1 trillion) help offset the $4.45 trillion tax cuts, but the net effect remains a substantial deficit increase.

Final Spending Cuts & Provisions

Healthcare and Social Safety Net Programs

The legislation targets several key social programs with substantial reductions affecting millions of Americans over the coming decade.

Medicaid Reductions (~$930 billion over 10 years) The most significant single cut affects Medicaid, with reductions enacted through expanded work and eligibility requirements, provider tax reductions, and cuts to federal matching payments to states. These changes are projected to reduce enrollment by approximately 12 million people, representing one of the most significant contractions of the Medicaid program since its inception.

SNAP (Food Stamp) Reductions (~$186 billion) The Supplemental Nutrition Assistance Program faces substantial cuts through tighter work mandates and increased cost-sharing requirements for states. These modifications are expected to remove approximately 3-4 million participants from the program rolls, affecting food security for low-income households nationwide.

Student Loan Program Savings (~$307 billion) Changes to federal student loan programs include tighter forgiveness rules and restructured repayment terms. These modifications will particularly impact borrowers seeking loan forgiveness and those entering new repayment plans, potentially affecting younger Americans' educational access and career planning.

Clean-Energy Credit Rollbacks (Part of ~$1.1 trillion in total cuts) The legislation accelerates the phase-out of Biden-era green energy tax credits, reducing federal support for renewable energy initiatives. This rollback affects individuals and businesses who had planned investments in solar, wind, and other clean energy technologies based on previous incentive structures.

Additional Discretionary & Mandatory Cuts Beyond the significant program reductions, the bill includes smaller-scale cuts affecting healthcare programs, regulatory funding, and administrative operations. These reductions contribute approximately $1.1 trillion in gross spending cuts across federal operations.

Spending Increases

Defense, Border Security & ICE Funding Boosts While implementing broad spending cuts, the legislation provides increased funding for defense operations, border security infrastructure, and Immigration and Customs Enforcement activities. These increases include specific earmarks for border wall construction, enhanced ICE staffing, and expanded immigration enforcement capabilities, partially offsetting the overall spending reductions.

In Conclusion

The passage of the OBBBA will remove an element of uncertainty for individuals, companies, and the financial markets. It is anyone's guess how this all will work out. No one can predict the future.

Monitoring your financial plans is critical, and updating your plan for any tax law changes is prudent. The uncertainty around tariffs, the Russia/Ukraine war, and the Israel/Gaza/Iran conflict are still geopolitical risks that will continue to impact financial markets. Most importantly, separating emotions or social concerns from your money decisions is essential.

Reed C. Fraasa is a CERTIFIED FINANCIAL PLANNER™ and founder of HIGHLAND Financial Advisors, a Fee-Only financial planning firm that offers comprehensive financial planning, retirement planning, and investment management. Reed has 30 years of experience as a fiduciary advisor and is the author of The Person is the Plan®, a unique financial planning process. Reed was a frequent guest contributor on PBS Nightly Business Report and has been featured in the New York Times, Wall Street Journal, and Star Ledger newspapers.

The foregoing content reflects the opinions of Highland Financial Advisors, LLC, and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions, or forecasts provided herein will prove to be correct.

Past performance may not be indicative of future results. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses, which would reduce returns.

Securities investing involves risk, including the potential for loss of principal. There is no assurance that any investment plan or strategy will be successful or that markets will act as they have in the past.

The above article was written with the assistance of artificial intelligence (AI).