By: Sean Gallagher, CFP®

The Federal Reserve remains front and center in financial headlines as policymakers continue navigating the delicate balance between controlling inflation and sustaining economic growth. The outcome of the Fed's most recent meeting, combined with expectations for rate decisions ahead and the potential leadership shift toward Kevin Warsh, provides important clues about what may lie ahead for borrowers and investors.

Let's walk through what's happening and, more importantly, what it means for personal finances and long-term investment decisions.

The Latest Fed Decision: A Pause After Prior Rate Cuts

At its most recent policy meeting, the Federal Open Market Committee (FOMC) chose to hold interest rates steady after cutting rates late last year. Policymakers acknowledged that inflation has eased from recent peaks, but it remains above the Fed's long-term 2% target. Meanwhile, economic growth remains stable, and the labor market continues to show resilience.

In practical terms:

The Fed policy is no longer tightening, meaning raising rates.

Officials are also not yet ready to cut rates aggressively.

Future decisions remain data-dependent, driven by inflation and employment trends.

For households and businesses, this pause means borrowing costs remain elevated relative to pre-pandemic levels but are no longer rising. The focus now shifts to when and how quickly rates might gradually decline.

Market Expectations: Gradual Rate Relief Ahead

Financial markets continuously update expectations for Fed policy, and current pricing suggests a slow, measured rate decline rather than rapid cuts.

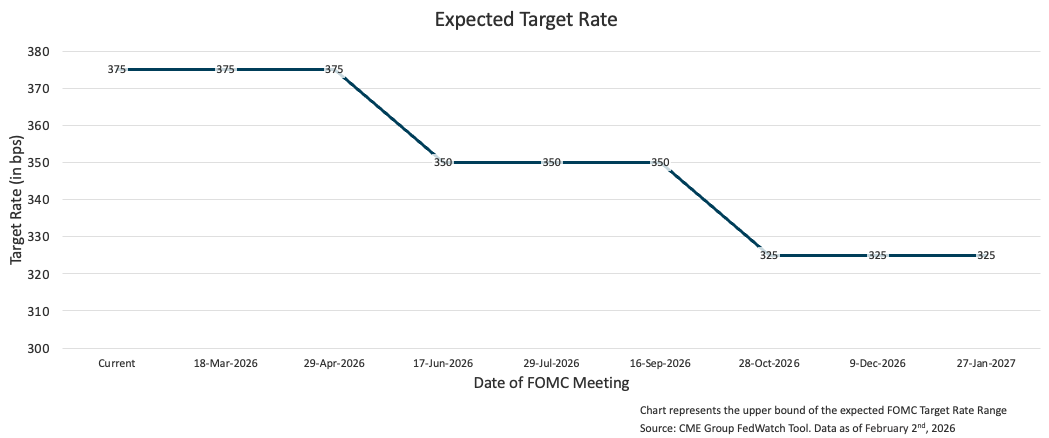

The chart above outlines CME Group's current expectations for the federal funds rate through early 2027. Markets currently anticipate:

Rates holding steady through spring,

Modest rate cuts beginning later this year,

Continued gradual easing into 2027.

This cautious outlook reflects two realities: inflation progress has slowed, and the economy remains strong enough that the Fed does not feel pressure to stimulate aggressively.

For consumers and investors, this suggests borrowing conditions are likely to improve, but relief will probably come slowly rather than all at once.

How This Impacts Borrowing Decisions

Higher interest rates over the past two years have affected mortgages, auto loans, home equity lines, and business financing. While expected rate declines should gradually help, borrowers should keep expectations realistic.

Mortgage rates, for example, do not move one-for-one with Fed policy. Long-term bond markets and inflation expectations also influence them, meaning rate improvements may be modest even if the Fed cuts rates later this year.

For households considering refinancing, purchasing a home, or making business investments, decisions should ultimately reflect personal financial circumstances rather than attempts to perfectly time interest rate movements. Waiting solely for lower rates could mean missing out if home prices or investment prospects continue to rise.

Investment Implications

For investors, the shift from rising rates to stable or falling rates changes market dynamics.

Over the past two years, higher rates pressured both stocks and bonds. Now, bonds once again offer attractive income potential, and if rates decline modestly, bond prices may benefit as well. Meanwhile, equity markets often respond positively when rate uncertainty declines, though corporate earnings and economic growth still matter far more over time.

This environment reinforces several investing principles:

Diversification remains critical.

Predicting rate timing is extremely difficult.

Long-term discipline typically outweighs short-term market reactions.

Investors who maintain balanced portfolios rather than trying to time rate moves tend to be better positioned across varying economic conditions.

Leadership Change: Could Kevin Warsh Shift Policy?

Another headline drawing attention is the nomination of Kevin Warsh as the next Federal Reserve Chair. Warsh, a former Fed governor, is often viewed as more open to rate cuts and cautious about keeping policy overly restrictive.

However, it is important to remember that Fed policy is set by a committee, not by a single individual. While leadership tone can influence discussions, decisions still depend heavily on incoming economic data and consensus among policymakers.

Leadership transitions may create short-term market uncertainty, but long-term investment outcomes continue to depend far more on economic fundamentals than on personalities.

What Investors and Households Should Focus On

Rather than trying to predict each Fed decision, individuals benefit most from focusing on areas within their control:

Maintaining diversified investment portfolios

Keeping debt levels manageable

Preserving emergency fund savings

Aligning financial decisions with long-term goals

Avoiding emotional reactions to short-term market headlines

The Fed's actions influence borrowing costs and market conditions, but sound financial planning remains effective across many interest-rate environments.

Final Thoughts

The Fed appears to be transitioning toward policy normalization. Rates are likely past their peak, but future cuts will probably arrive gradually. Borrowing costs should ease over time, and investment markets may continue adjusting to a more stable policy backdrop.

We will continue monitoring developments and evaluating their impact on financial planning strategies. If you're considering borrowing decisions, portfolio adjustments, or simply want to understand how policy shifts impact your long-term plan, we're always happy to discuss how these changes fit into your financial picture.

The foregoing content reflects the opinions of Highland Financial Advisors, LLC, and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions, or forecasts provided herein will prove to be correct.

Past performance may not be indicative of future results. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses, which would reduce returns.

Securities investing involves risk, including the potential for loss of principal. There is no assurance that any investment plan or strategy will be successful or that markets will act as they have in the past.

The above article was written with the assistance of artificial intelligence (AI).