By: Edward J. Leach, CFP®, MBA, CEPA®

If 2025 felt uncomfortable at times, you were not alone, and that discomfort is precisely why this year is worth reflecting on.

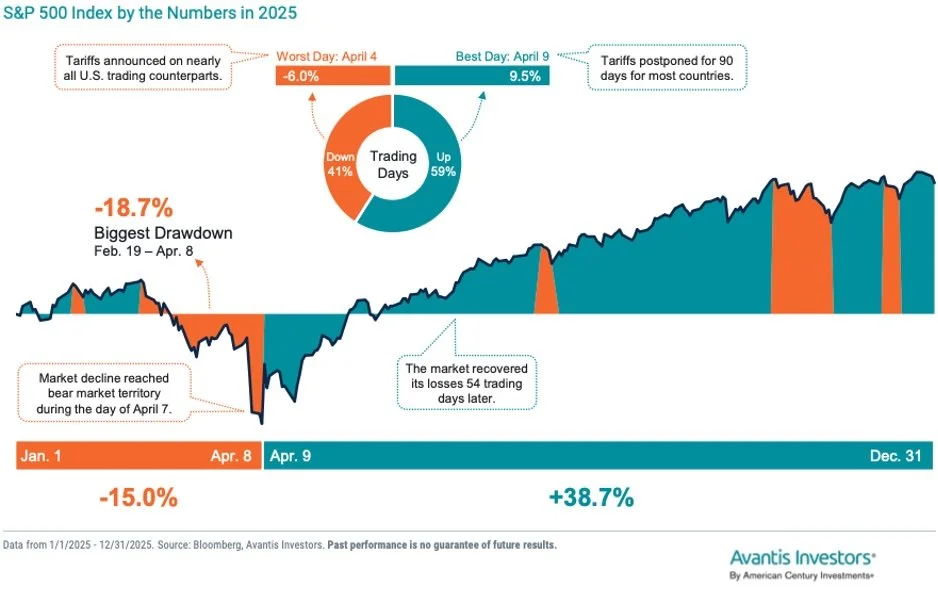

Early in the year, we all watched as markets reacted sharply to headlines surrounding tariffs, trade policy, and geopolitical uncertainty. The chart included here from Avantis Investors Field Guide helps visualize what many of you felt in real time: sudden declines, quick reversals, and stretches where the news seemed to change by the day.

However, stepping back, 2025 reinforced several important lessons that continue to guide our investment approach.

Here are three key takeaways from 2025:

1. Stress Tends to Peak When Clarity Is Lowest

In the first quarter, markets experienced heightened volatility as new tariffs were announced and policy direction felt uncertain. During that stretch, prices moved sharply, and confidence was tested, with markets briefly entering bear market territory during the trading day.

Moments like these are challenging because they feel open-ended. Historically, periods of maximum uncertainty often occur when markets are reacting to incomplete information rather than lasting changes in fundamentals.

What this means for you: Feeling uneasy during volatile periods is normal, but that discomfort alone is rarely a signal that a long-term plan needs to change.

2. The Most Important Days Do Not Announce Themselves

One of the most striking messages from 2025, as highlighted in the chart, is the proximity of the year's worst and best market days. Shortly after some of the most negative headlines, markets experienced some of their strongest short-term rebounds, often before confidence had fully returned.

This uncertainty is why trying to leave the market during stressful moments can be so costly. When markets recover, they often do so quickly, and missing just a handful of key days can significantly alter long-term outcomes.

What this means for you: Staying invested through uncertainty helps ensure you are present when markets move forward, often sooner than expected.

3. Diversification Helped You Stay the Course

While much of the attention in 2025 centered on the U.S. market, market leadership during the year was not concentrated in a single location. Non-U.S. stocks meaningfully outpaced U.S. stocks over the course of the year, reinforcing the value of maintaining global equity exposure rather than relying on any single market.

Importantly, this leadership was not driven by a single event or short-term trend, but by sustained participation across international markets. At the same time, fixed income continued to play an essential role in providing balance during periods of equity volatility, supporting portfolio stability when stock markets experienced stress.

This is exactly why we emphasize diversification across regions and asset classes. Rather than trying to predict which market or asset class will lead next, diversified portfolios are designed to adapt as leadership changes, helping you stay invested and focused on your long-term plan, rather than reacting to headlines.

What this means for you: Diversification is not about avoiding volatility; it is about giving you the confidence to stay invested when volatility shows up.

The Bigger Picture

Markets are unpredictable in the short term, and headlines often feel more urgent than they truly are. As we close out 2025, the year reinforces a critical truth: long-term success is built through patience, discipline, and the ability to stay focused when uncertainty shows up.

At HIGHLAND Financial Advisors, our role is to help you stay grounded during uncertain moments and remain focused on what truly matters: your goals, your plan, and your long-term financial well-being.

Ed Leach, CFP®, MBA, is a Partner and Wealth Advisor at HIGHLAND Financial Advisors, LLC in Wayne, NJ, and works directly with clients advising them on their financial planning and investments. Ed’s work focuses on the unique needs of business owners, helping them extract value from their businesses while creating efficiencies in their business and personal financial plans. He is also a member of NAPFA, which is dedicated to serving fee-only advisors.

The foregoing content reflects the opinions of Highland Financial Advisors, LLC, and is subject to change at any time without notice. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions, or forecasts provided herein will prove to be correct.

Past performance may not be indicative of future results. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses, which would reduce returns.

Securities investing involves risk, including the potential for loss of principal. There is no assurance that any investment plan or strategy will be successful or that markets will act as they have in the past.

The above article was written with the assistance of artificial intelligence (AI).