One of our primary responsibilities as wealth advisors is helping clients navigate the delicate see-saw of life’s two most precious resources – time and money. While financial planning often takes center stage, I’ve found that conversations about how people spend their time can be just as impactful, if not more so. After all, money can be earned, saved, and invested—but time, once spent, is gone for good.

Keep More of What You Earn: 5 Tax-Efficient Investment Strategies

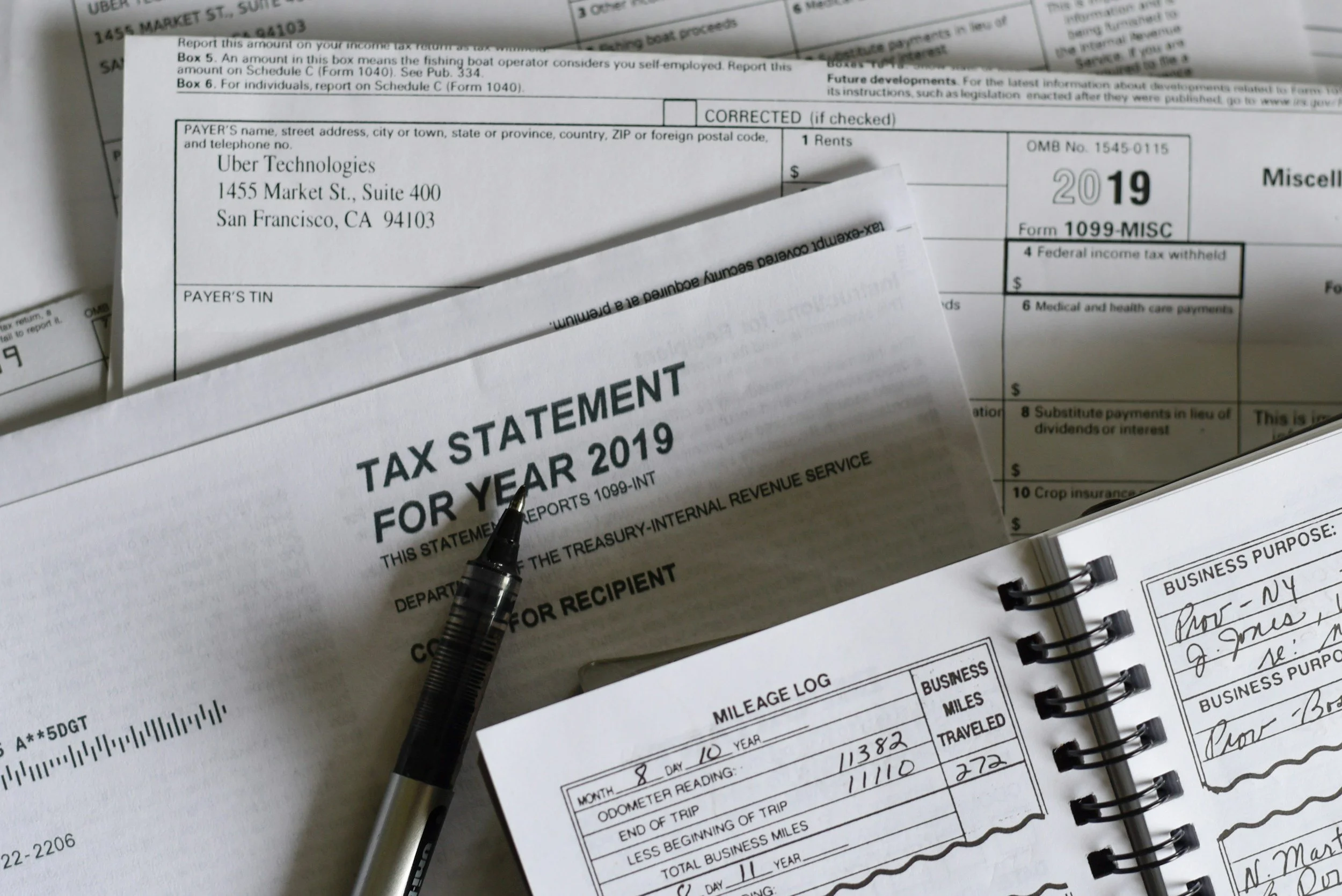

As a financial advisor, I often remind clients that investment returns are only part of the story—the after-tax returns are what truly matter. Without careful planning, taxes can erode your gains year after year. Fortunately, there are several strategies you can use to reduce your tax liability and grow your wealth more efficiently.

What Baking a Cake Can Teach Us About Building a Better Investment Portfolio

One Big Bill, One Big Question: Are Your Taxes Going Up?

One of the most critical pieces of legislation we're watching is how Congress will address the sunsetting provisions of the Tax Cuts and Jobs Act (TCJA). In 2017, President Trump passed the TCJA, which delivered broad tax relief, but many of its key provisions are set to expire at the end of 2025. What happens next could impact your income, deductions, and overall financial plan very realistically, especially regarding taxes.

Your Dream Summer Vacation Without the Financial Hangover

Summer vacation season brings excitement, but it shouldn't derail your long-term financial objectives. As a Certified Financial Planner®, I regularly help people navigate the challenge of enjoying meaningful travel experiences while staying committed to their retirement savings, emergency funds, and debt reduction goals. The key lies in strategic planning and making your travel budget work within your overall financial framework.

5 Ways to Ensure Your Investments Are Tax Efficient

For high-net-worth families, investing wisely is only part of the equation. Preserving wealth through tax efficiency is just as critical. Tax planning can dramatically affect long-term returns, especially when compounded over decades. Here are five strategies to help ensure your investments are working as hard after taxes as they are before.

What To Do With Your Paycheck

The Ultimate Guide to Life Insurance for Dental Practice Owners

Mid-Year Financial Check-In: Assessing Your Progress on Savings, Debt, and Investments

May is a great time to step back and take stock of your personal finances. The rhythm of tax season is behind you, and there's still plenty of time left in the year to make strategic adjustments. Whether working toward long-term goals or simply staying organized, a thoughtful financial check-in can help ensure you're on track and making the most of your resources.

When Should You Recalibrate Your Retirement Savings Strategy?

As a financial advisor, one of the most important conversations I have with clients is not just about saving for retirement—it's about evolving their strategy over time. Individuals often treat retirement planning as a "set it and forget it" exercise. Your savings strategy should be dynamic, adapting to reflect the inevitable shifts in your life and the broader financial landscape.

What If We Planned for What Could Go Right?

The Long-Term Implications of Trump's Tariff War

The Fast Track to Zero: Supercharge Your Debt Repayment Strategy

Tackling debt can feel like climbing a mountain, but with the right strategy, you can reach the debt-free summit faster than you might think. Whether dealing with credit cards, student loans, or other forms of debt, implementing a structured approach can save you thousands in interest and free you from financial burden sooner.

Why Trump’s Liberation Day Tariffs Shook the Markets to Their Core

As fiduciary financial advisors, we strive to remain objective and apolitical in our advice. Political bias can lead investors to make poor decisions, and our role is to offer clear guidance grounded in facts. With that in mind, we offer a measured explanation of the market’s response to President Trump’s newly implemented tariffs.